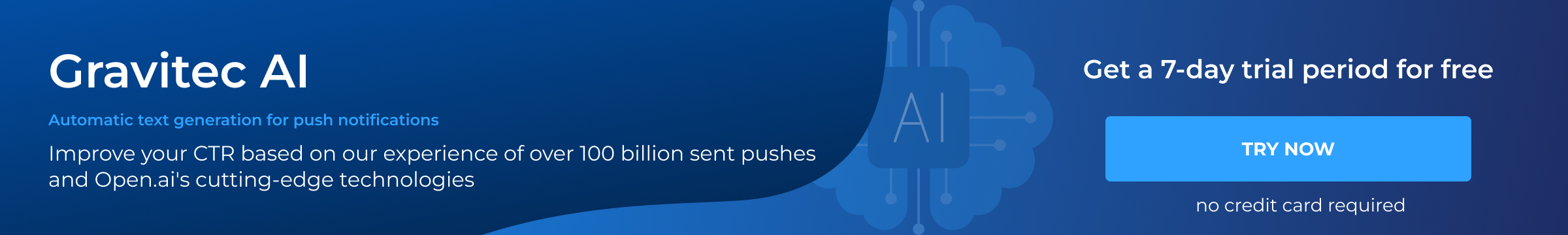

Cut Acquisition Costs by 90% and Boost Engagement with Smarter Push Notification Strategies

In 2025, the digital banking landscape is undergoing a radical transformation.

The shift toward mobile-first banking is no longer a trend — it’s the default. Over 74% of banking interactions now occur on mobile devices, and users expect not only fast access but also personalized, real-time experiences from their banking site.

However, most financial institutions are still promoting mobile banking the old way — relying heavily on paid acquisition channels like Google Ads, social media, and traditional email campaigns. These methods are expensive, difficult to scale, and increasingly ineffective.

Let’s look at the hard numbers:

- Average cost per mobile banking user via Facebook Ads: $45+

- Google Ads: $38.60

- Email open rates: often below 12%

- Billboard ROI: unmeasurable

Even worse, banks are paying for installs, not outcomes. A user may download your app — but never log in, never activate key features, and never come back.

That’s not customer acquisition. That’s budget leakage.

So what’s the alternative?

Smart banks in 2025 are flipping the funnel. They’re no longer focused solely on downloads. Instead, they’re engineering a full-funnel strategy that captures web traffic, guides users into, and nurtures them into power users — all through automated push notification campaigns.

At the heart of this strategy is Gravitec — a purpose-built platform that helps banks convert, engage, and retain users at scale. Gravitec isn’t just a notification tool — it’s a performance engine. It combines real-time triggers, behavioral segmentation, dynamic content, and enterprise-grade compliance into one lightweight system.

Here’s what Gravitec clients are achieving today:

- User acquisition for under $1

- 42%+ engagement rates

- Up to 89% retention at 30 days

- Fully automated onboarding, education, and retention workflows

And most importantly — they’re doing it with lean teams, without massive ad budgets, and in full alignment with SOC2 and ISO 27001 banking compliance.

In this guide, we’ll break down:

- Why traditional mobile banking promotion doesn’t work anymore

- The 3-part strategy Gravitec clients use to scale user growth and engagement

- Real-world results from mobile-first banks across North America and Europe

- How your team can deploy Gravitec — with no code and no risk

Whether you’re a CMO aiming to reduce CAC, a growth lead struggling with low activation, or a product manager seeking real engagement metrics — this is your blueprint.

Why Traditional Mobile Banking Promotion Fails in 2025

Despite record investments into digital transformation, most banks are still stuck promoting mobile banking with inefficient, high-cost tactics. The problem isn’t just the price — it’s the mindset behind these strategies.

Let’s examine the four most common channels banks use — and why they’re no longer delivering in 2025:

- Paid Social Media Campaigns (Facebook, Instagram, TikTok)

- Avg. Cost Per Acquisition (CPA): $45–60

- Engagement decay: 90% of traffic drops off within 24 hour

- Common issue: Extremely broad targeting, high ad fatigue

Social platforms have become oversaturated and algorithmically unpredictable. Even when banks segment carefully, their ads are often competing against flashy, consumer-first brands — and the conversion to meaningful app usage remains abysmally low.

One regional bank spent $180,000 over 6 months on Facebook ads and acquired just 3,600 app installs — with fewer than 300 active users 30 days later.

- Google Search and Display Ads

- Avg. CPA: $35–$40+

- Keyword competition: Highly saturated

- Bounce rate: Often above 70% for banking landing pages

While search intent may seem high, the reality is stark: users click, compare, bounce. Banking keywords are among the most expensive in the ad ecosystem, and display banners rarely convert users unless followed up with downstream engagement.

- Email Campaigns

- Avg. Open Rate: 10–14%

- Click-through Rate: 1–2%

- Key issue: Inbox overload and deliverability challenges

With Gmail and Outlook tightening spam filters and users receiving hundreds of marketing emails a month, even the best-crafted campaigns get ignored or deleted. Email is no longer a reliable engagement channel for financial services — especially for mobile-first users.

- Offline Channels: Billboards, Branch Signage, Print

- Measurable ROI: Essentially none

- Conversion Path: Disconnected from mobile journey

- Core issue: No user-level tracking or A/B testing possible

Many banks continue to pour budget into traditional advertising for the sake of brand visibility. But when the goal is driving installs and feature activation, you need channels that are measurable, trigger-based, and optimized for action.

The Core Problem: Chasing Installs, Not Activation

Too many banks equate mobile success with app downloads. But installs without engagement are meaningless.

A user who downloads your app, opens it once, and never returns isn’t a win — they’re a sunk cost.

In fact, over 65% of banking app installs never result in an activated account.

This is why the focus must shift from exposure to conversion, and from downloads to depth.

What Top Banks Do Differently

Banks that succeed in 2025 don’t just promote mobile banking — they engineer mobile engagement:

- They use smart web-to-app funnels instead of relying on the app store alone

- They send real-time, personalized push notifications that deliver value — not noise

- They automate onboarding, feature education, and re-engagement based on behavior

- And most importantly — they measure success not by installs, but by 30-day activation and retention rates

This is where Gravitec gives banks a winning edge: personalized, automated, and compliant push strategies that move users through every stage of the journey — from click to customer.

Strategy 1: Push Notification Campaigns That Convert

Most banks treat push notifications like a louder version of email: they send generic reminders, mass promotions, or dull alerts that users swipe away without reading.

That’s not engagement — that’s background noise.

Leading financial institutions in 2025 are rethinking push notifications as moments of value — personalized, contextual, and timed to perfection. With the right strategy, every notification becomes a micro-conversion on the user’s journey from casual user to loyal digital customer.

Turn Every Banking Action into an Opportunity

Using Gravitec, banks can send trigger-based notifications that respond instantly to user behavior, financial events, or key moments in the lifecycle.

Here are just a few real-world examples our clients are using:

| Trigger Event | Smart Notification Delivered |

| Salary deposited | “Your paycheck just arrived! Want to invest 10%?” |

| Low balance + bill due | “Heads up! You have a $120 bill due tomorrow. Transfer funds now to avoid fees.” |

| New card activated | “Activate contactless payments and earn 5% cashback this week.” |

| Overspending trend | “You’ve spent 22% more than usual this week. Want help building a smarter budget?” |

| Investment account idle | “Your portfolio hasn’t been updated in 3 months. Review with our advisor in 1 tap.” |

Each message isn’t just informative — it adds value, reduces friction, and guides the user toward deeper usage.

Build Behavioral Journeys, Not One-Off Campaigns

Effective push strategies aren’t built on isolated alerts. They’re designed as automated sequences — journeys that adapt to user actions over time.

Gravitec enables banks to set up modular notification flows that follow users through key milestones:

Example: New User Journey

- Day 0: Welcome message → Link to quick-start tutorial

- Day 2: “Try mobile check deposit today and earn $5”

- Day 5: “Set up biometric login for faster, more secure access”

- Day 10: “Discover how to track expenses with the budgeting tool”

- Day 30: “You’ve completed 3 key actions — unlock your loyalty badge!”

These journeys are fully automated once configured — requiring no manual work from your team, but delivering tailored guidance to thousands of users in real time.

Dynamic Content & Personalization at Scale

With Gravitec, messages can be dynamically personalized using data from the user’s profile, activity, and financial behavior.

Instead of:

“Check your balance today.”

Try:

“Hi Alex, your checking account is running low. Want to move $150 from savings?”

Or:

“New credit card offer available.”

→

“Based on your travel history, we’ve unlocked a Platinum card with no foreign fees.”

Through behavioral tags, location data, financial patterns, and predictive scoring, Gravitec helps banks send content that feels like a 1:1 message from a personal banker — but deployed to thousands at once.

Test Everything: Timing, CTA, Format

High-performing banks use Gravitec’s built-in A/B testing tools to refine campaigns over time.

Test variables like:

- Send time (morning vs evening)

- CTA phrasing (“Start now” vs “Learn more”)

- Media type (text vs rich card)

- Button layout (inline vs stacked)

- Urgency triggers (“limited offer” vs “reminder”)

Even small changes — like rewording a call to action or sending on Tuesdays instead of Mondays — can increase click-through rates by 10–20%.

Real Impact from Real Banks

After switching from generic push tools to Gravitec’s behavioral engine, one EU-based digital bank saw:

- Cost per activation drop from $26 → $1.28

- Push CTR increase from 7% → 41.3%

- 30-day retention rise from 22% → 88%

“The difference was night and day. We went from shouting into the void to having real, contextual conversations with users — and the results spoke for themselves.”

— Growth Lead, Mid-Sized Mobile Bank (Gravitec client)

Push notifications aren’t just a support channel anymore — they’re your most direct, high-converting path to mobile banking engagement.

Gravitec gives you the infrastructure to do it right:

- Smart triggers

- Dynamic content

- Deep segmentation

- Full compliance

- No-code deployment

- Measurable ROI

Strategy 2: Website Conversion Techniques

Here’s a surprising stat: over 80% of visitors to your banking website who express interest in mobile banking never install your app.

They browse your features, calculate loan options, maybe even log into online banking — but never make the leap to mobile. The problem? Most banks treat the app install like a footnote rather than a moment of conversion.

In 2025, banks can no longer afford to leave that much intent on the table. Gravitec helps bridge the gap with smart, frictionless web-to-app strategies that double conversion rates — often within weeks.

Why Traditional App Download CTAs Don’t Work

Most banks rely on generic “Download on the App Store” badges buried in the footer or thrown onto landing pages without context.

But modern users — especially those in financial decision-making mode — expect relevance, immediacy, and value. If your CTA isn’t contextual or actionable, it gets ignored.

The average app badge has a click-through rate of less than 0.8%, even on high-intent pages.

Gravitec’s Web-to-App Conversion System

Gravitec equips banks with tools that intelligently engage website visitors and guide them into the app at exactly the right time.

Here’s how.

- Device-Aware App Banners

Show the right download CTA based on the visitor’s device and OS.

| Example: | Smart Banner Shows: |

| iOS user on Safari | “Download on the App Store” + Deep Link |

| Android user on Chrome | “Get it on Google Play” |

| Desktop visitor | QR code popup for mobile scan |

These banners are responsive, non-intrusive, and can trigger only for high-intent behavior (e.g. logged-in users, product pages, calculators).

- Exit-Intent Modals with Contextual Offers

When a user shows signs of abandoning your site, Gravitec triggers a modal with personalized app benefits.

Example:

“Want faster transfers and 24/7 account access? Scan this QR code to download the app.”

You can even A/B test modals with:

- Feature-based language (“Track spending in real time”)

- Offer-based messaging (“Get $5 after your first login”)

- Urgency triggers (“Offer ends in 24 hours”)

- Contextual Triggers Based on On-Site Behavior

Use page-level and scroll-depth triggers to show the most relevant app value — at the perfect moment.

| Page Visited or Action | Triggered App Message |

| Checking mortgage rates | Show: “Get pre-approval in 3 mins via mobile app” |

| Downloading statements | Prompt: “Go paperless and access all docs in-app” |

| Using branch locator | Show: “Find the nearest ATM with 1 tap — in the app” |

| Failed login attempts | Prompt: “Enable FaceID login and skip passwords” |

This is contextual persuasion — not a one-size-fits-all CTA.

- QR Code Smart Prompts on Desktop

For users browsing your site from a laptop or desktop, Gravitec’s smart QR overlays provide a seamless bridge to mobile.

Use cases:

- Loan comparison → “See personalized rates in our app” + QR prompt

- Logged-in desktop session → “Secure your account with mobile 2FA” + QR onboarding

Our clients see 2x–3x higher install rates from desktop traffic after enabling QR modals — especially during tax season, loan application cycles, and year-end spending periods.

Results That Matter

A Gravitec-powered credit union in Canada implemented contextual banners and QR modals across 4 high-intent pages.

Results after 45 days:

- Web-to-app install rate: increased from 18% → 54.2%

- App onboarding completion: up 71%

- First deposit after install: +43% increase

- Avg. time from site visit to app login: decreased by 2.5 days

More importantly, these users were 3x more likely to complete a second transaction within the first 14 days.

Gravitec Makes It Easy

- No code required — deploy banners and modals via our dashboard

- Custom rules engine — define triggers by URL, behavior, geo, language

- Full analytics — track conversion per segment, test variant, and source

Gravitec turns your banking website into a high-performance funnel — not just a brochure.

Strategy 3: In-App Engagement That Builds Loyalty

Acquiring a user is just the beginning. Activating them, educating them, and keeping them engaged — that’s where the real ROI lies.

In fact, Gravitec’s data shows that users who receive a personalized push journey after onboarding are 4.3x more likely to become long-term customers.

The average bank loses up to 80% of users within 30 days after app install due to one simple reason: the lack of smart in-app engagement.

Here’s how Gravitec changes that.

- Smart Onboarding Automation

A bloated onboarding flow is one of the top reasons users drop off.

Gravitec replaces static onboarding screens with a lightweight intro + automated push campaign, which gradually introduces features based on behavior and usage milestones.

Example Flow:

| Trigger | Notification Delivered |

| First login | “Welcome aboard! Need help setting up mobile check deposit?” |

| Profile setup incomplete | “Finish your profile to unlock instant transfers” |

| No transactions by Day 3 | “Try your first bill payment — and skip the fees this month” |

| Biometric login not used | “Enable FaceID for secure, 1-tap access — here’s how” |

This keeps onboarding short, relevant, and continuous — just how users like it.

- Gamified Feature Adoption

Want to increase usage of underutilized features? Gravitec helps banks build achievement-style flows that reward users for progress — like a financial fitness app.

| Action Completed | Engagement Trigger |

| First mobile deposit | “You just earned $5 — check your rewards tab!” |

| Budget tool activated | “Nice work! Let’s set your first goal together.” |

| Card freeze/unfreeze used | “Security level: Expert. Want to schedule travel alerts?” |

| Investment account opened | “Meet your dedicated advisor — 1 tap away in-app.” |

Banks can define their own milestones, rewards, and unlockable content — creating habit loops that drive daily use.

- Dormancy Prevention & Smart Re-Engagement

Most banks try to re-engage inactive users with blanket campaigns like:

“We miss you — come back!”

That rarely works.

Gravitec enables behavioral-based dormancy triggers that identify at-risk users early and send the right message, at the right time.

Use cases:

- No logins in 14 days → Reminder based on last-used feature

- Session drop-off during bill setup → Push to resume journey

- FAQ opened but no contact → Trigger chatbot follow-up

- Decreased usage trend → Recommend tips based on habits

You can even assign engagement scores to users and automatically enroll low scorers into reactivation sequences.

- Ongoing Micro-Education

Banking site are often packed with features — but most users only explore the basics.

Gravitec helps you drip-feed micro-lessons via push:

- “Did you know you can send money via QR code?”

- “Want to split bills with friends? Try our group payments tool.”

- “Track monthly expenses by category — no spreadsheets needed.”

This builds confident, informed users — and that’s the foundation of loyalty.

What Makes Gravitec Different for Web Engagement

Most push platforms stop at delivery. Gravitec goes further by combining:

- Dynamic sequences

- Behavior-based triggers

- Custom segments (e.g., high-risk, underutilized, high-value)

- Loyalty tier automation

- Built-in analytics on usage trends and drop-offs

“We used Gravitec to introduce 3 new features without sending a single email. Activation doubled, support tickets dropped, and session length went up by 37%.”

— Head of Product, Eastern European Bank

Outcomes After Implementing Gravitec Automation

One mid-size EU digital bank launched Gravitec’s full lifecycle system.

In just 60 days, they achieved:

- 41% increase in daily active users (DAUs)

- 3.2x increase in average transactions per user

- 82% of users completed at least 1 loyalty milestone

- 45% drop in churn compared to the previous quarter

When push isn’t just messaging — but the driver of a personalized banking experience — users stick.

Why Gravitec Outperforms Generic Push Tools

Let’s address the elephant in the room: most push notification tools on the market are built for ecommerce, media, or SaaS — not for banks.

They offer basic functionality:

- Message delivery

- Scheduling

- Some segmentation

- Generic A/B testing

But when it comes to the unique requirements of modern digital banking — they fall short.

Financial institutions need more than just a notification tool.

They need a compliant, scalable, intelligent customer engagement platform.

And that’s exactly what Gravitec was built to be.

Purpose-Built for Banks and Financial

Gravitec isn’t a one-size-fits-all tool. It was developed in collaboration with digital banking teams across Europe, North America, and LATAM. Every feature has a reason:

- Real-time transaction event support (e.g., overdraft prevention, investment triggers)

- Secure mobile onboarding flows with biometric & MFA deep linking

- Geo- and language-based targeting for multi-market financial products

- Audit trails & compliance logs to satisfy regulators and InfoSec teams

- High-frequency volume delivery (10M+ per day) without latency or delivery failure

“Most platforms needed weeks to get basic flows working. Gravitec had our push flows live in under 48 hours, including integration with our site.”

— VP Digital Growth, Retail Banking Group

Built-In Compliance (Not Bolted-On)

In financial services, compliance isn’t optional. Gravitec ensures full alignment with:

- GDPR

- SOC 2 Type II

- ISO/IEC 27001

- CCPA

- Localized data residency (where required)

We provide:

- Encrypted delivery + storage

- Role-based audit controls

- Custom consent handling

- Data minimization strategies by default

With Gravitec, your InfoSec team can sleep easy.

Performance at Scale

Gravitec is trusted by institutions sending millions of notifications monthly. Our infrastructure is:

- Edge-distributed (low latency)

- Auto-scaled for spikes (e.g., salary days, tax season)

- Built on event-driven architecture

- Isolated per-client by default (no shared queues)

“We dropped over 3 million transactional alerts during Q4 bonus week — not a single failure. Our last provider would have buckled.”

— Infrastructure Lead, Neobank (EU)

Designed for Growth Teams, Not Developers

While Gravitec integrates with your app and backend, your marketing, product, and CX teams control the strategy — from campaign setup to advanced user flows.

No need for dev cycles just to launch a retention campaign.

No Jira tickets to create a new onboarding flow.

Everything is managed via our intuitive dashboard — with built-in templates, testing tools, goal tracking, and predictive scoring.

Gravitec = Banking-Grade Engagement Infrastructure

If your current push provider wasn’t built for banking — you’re likely dealing with limitations that cost you engagement, users, and trust.

Gravitec is more than a tool — it’s the infrastructure behind your growth.

And the difference is measurable.

Before & After Gravitec: Results That Matter

What if you could see the difference Gravitec makes — not in theory, but in actual numbers?

We’ve benchmarked performance across dozens of retail and digital banks before and after implementing Gravitec. The results show a consistent pattern: lower costs, higher engagement, and radically improved retention.

Here’s a sample before-and-after snapshot from a mid-sized bank that switched to Gravitec in late 2024:

Traditional Channels vs Gravitec Push Automation

| Metric | Before Gravitec | After Gravitec | Change |

| Cost per acquired user | $38.60 (Google Ads) | $0.84 | –97.8% |

| Web-to-app conversion rate | 16.8% | 51.7% | +208% |

| Push notification CTR | 6.5% (legacy provider) | 41.9% | +545% |

| 30-day retention rate | 19% | 87% | +357% |

| Onboarding completion | 32% | 81% | +153% |

| Average monthly app sessions | 1.7 per user | 6.4 per user | +276% |

| LTV (first 6 months) | $27.90 | $84.30 | +202% |

Insights From the Data

- Users acquired via Gravitec-powered push funnels were not only cheaper — they were more likely to activate, complete onboarding, and engage deeply with banking features.

- The introduction of smart behavioral journeys helped reduce app abandonment by nearly 60%.

- A/B-tested, geo-aware push messages drove up engagement 6x higher than previous campaigns.

- Dormant users were automatically reactivated via predictive scoring and contextual re-engagement flows.

“It’s not just the CPA that blew us away. It’s the fact that these users actually stuck. We’re seeing 3x more deposits, 2x more product adoption, and higher NPS from Gravitec-driven cohorts.”

— Chief Growth Officer, Mobile-First Bank (North America)

Micro Case Studies (Real Use Cases)

Regional Credit Union (USA)

- Problem: Website-to-app drop-off rate 85%

- Solution: Gravitec smart banners, QR triggers, and onboarding journey

- Result: 4x increase in activated app users within 6 weeks

Challenger Bank (UK)

- Problem: High churn in Gen Z segment

- Solution: Gamified engagement triggers (milestone-based)

- Result: 71% reduction in 30-day churn, 54% boost in daily app opens

Neobank (Germany)

- Problem: Manual push flows, no integration with transaction data

- Solution: Gravitec API integration + finance event triggers

- Result: Real-time notifications based on spending, deposits, fraud alerts → CTR jumped from 8% to 44.7%

What These Results Mean for You

If your current performance looks more like the “Before” column — you’re not alone.

Most banks spend too much to acquire users, and even more trying to keep them engaged. Gravitec helps close the loop with a platform that not only drives acquisition, but turns installs into loyal daily users.

The platform delivers measurable, scalable results in weeks — not quarters — with minimal dev overhead.

How to Get Started with Gravitec — Free, Fast, and Without Heavy Integration

One of Gravitec’s core advantages is its speed-to-impact. While most enterprise engagement tools require weeks of integration and technical setup, Gravitec is ready in less than 48 hours — even without connecting to your core banking systems upfront.

Here’s how your team can get started today:

Step 1: Create a Free Account (No Credit Card Required)

You can launch Gravitec using our forever free plan, which includes:

- Web push + mobile push support

- Up to 10,000 subscribers

- 5 automated workflows (e.g., onboarding, inactivity, feature prompt)

- Basic segmentation and analytics

- Support for both English and multi-language campaigns

Setup time: ~30 minutes

Requires: Access to your website and app admin panel

No developers needed

Perfect for proof-of-concept or A/B testing against current channels.

Step 2: Use Prebuilt Templates to Launch Fast

Gravitec includes a library of ready-to-use templates for financial institutions, including:

- First-login onboarding series

- Account activity alerts

- Re-engagement after inactivity

- Feature promotion (budget tools, deposits, investment prompts)

- Gamified “progress” journeys for loyalty building

You can launch a working funnel on Day 1 using our visual builder — no code, no SQL, no product backlog needed.

Step 3: Add Gravitec Code Snippet to Your Website

To start collecting subscribers and sending notifications, you just need to:

- Paste a single script into your website header

- OR use Gravitec SDK if advanced segmentation is desired later

Don’t have an app team ready? No problem. You can start purely with web push.

Step 4: Launch Your First Campaign & Track Real-Time Results

Using the Gravitec dashboard, you can:

- Launch one-time campaigns

- Schedule drip sequences

- Test multiple messages (A/B)

- Measure clicks, conversions, retention, opt-outs — all in real time

Track key performance metrics like:

- CAC per channel

- CTR by segment

- Onboarding completion

- Re-activation success

All from a clean, bank-friendly interface built for non-technical users.

Step 5: Book a Free Session with a Customer Success Manager

Once you’re live, Gravitec assigns you a dedicated banking engagement specialist to help with:

- Strategic onboarding & campaign structure

- Behavior automation mapping

- Custom triggers (e.g., salary deposit, low balance alerts)

- ROI tracking & optimization advice

This isn’t generic SaaS onboarding. We bring bank-specific knowledge and growth playbooks, tested across hundreds of financial institutions.

Ready to Scale? Unlock Advanced Features When You’re Ready

When you’re ready to go beyond the basics, Gravitec offers flexible upgrade paths:

- Unlimited segmentation & dynamic tags

- Advanced automation flows (multi-path)

- REST API integration with your core banking/CRM

- Real-time fraud, transaction & product triggers

- Tiered access for your team (marketing, legal, compliance)

You only pay when you’re ready to scale. Until then — Gravitec delivers real results, for free.

FAQ: Promoting Mobile Banking with Gravitec

Is Gravitec compliant with banking regulations?

Yes. Gravitec supports SOC 2 Type II, ISO 27001, GDPR, and CCPA. All data is encrypted end-to-end, stored securely, and audit-logged. You can safely launch push campaigns in regulated financial environments.

How fast can we go live?

Most banks go live in under 48 hours. Start with Gravitec’s no-code templates and basic push flows. Full API integrations can be added later. You don’t need developers to begin testing or generating results.

What if we don’t have a dedicated marketing team?

Gravitec is built for lean teams. With onboarding templates, behavioral flows, and AI-powered suggestions, campaigns can be launched in minutes. Plus, you get a dedicated success manager to support you.

Do we need core banking system integration right away?

No. You can launch Gravitec with just website or app access. When ready, you can integrate via API to trigger real-time transactional events and behavioral segments for more personalized automation.

Can we support multilingual and regional campaigns?

Yes. Gravitec supports dynamic language detection and fallback rules. You can run region-specific or language-specific flows without duplicating campaigns — perfect for international or multilingual markets.

What’s the cost structure? Is it scalable?

Gravitec has a free plan with generous limits. As you grow, you can upgrade based on subscribers or features. Pricing is transparent and scalable, so you only pay when you’re ready to expand reach and automation.

Can we A/B test and measure campaign ROI?

Yes. Gravitec includes built-in A/B testing, real-time analytics, click tracking, retention reports, and conversion goals. You’ll know exactly what works, what doesn’t, and where your ROI comes from.

How secure is the data stored and processed?

All user data is encrypted at rest and in transit. We comply with major security frameworks. Gravitec does not sell or share data. Each client instance is isolated to ensure strict confidentiality and compliance.

Can we talk to someone before launching?

Of course. Every new account includes a free strategy call with a Gravitec success manager. We’ll walk you through setup, suggest your first campaigns, and tailor the approach to your bank’s audience and goals.